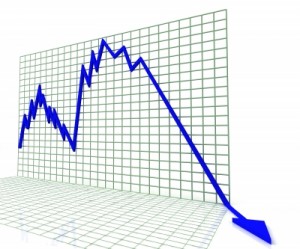

Car sales have been up. There are a lot of reasons why this is happening. One is that the average ages of vehicles are at the point where it’s cheaper to replace them rather than repair them. Another, one that’s closer to heart here in New York, is because of Hurricane Sandy. New Yorkers had their cars wrecked by the super-storm and were forced to get back in the market in the aftermath. This influx of buyers caused the prices of used-vehicles to surge. The used-car market has had a hard time keeping up in both inventory and by seeing the cost come close to that of a new car. Not the best deal for someone looking to purchase pre-owned. Thankfully, the higher cost is coming to an end.

Car sales have been up. There are a lot of reasons why this is happening. One is that the average ages of vehicles are at the point where it’s cheaper to replace them rather than repair them. Another, one that’s closer to heart here in New York, is because of Hurricane Sandy. New Yorkers had their cars wrecked by the super-storm and were forced to get back in the market in the aftermath. This influx of buyers caused the prices of used-vehicles to surge. The used-car market has had a hard time keeping up in both inventory and by seeing the cost come close to that of a new car. Not the best deal for someone looking to purchase pre-owned. Thankfully, the higher cost is coming to an end.

Fi-magazine.com has the breakdown of why the analysts see a shift coming. Before the beginning of the year, prices were already starting to go down, but Sandy broke that trend. February showed that the market was finally getting away from that upswing, as the price for a used-vehicle was averaged at $9,752. That figure is down 2.8 percent from the month of January. The exception to the drop was the Mini SUV segment that went up 1.9 percent.

The sales figures for used vehicles remain strong as the year goes on. The franchised dealers were up by 11.6% in February and the independent dealers were up 4.4%.

If you’ve been having cold feet about coming into Bayside Chrysler Jeep Dodge due to the recent news of increased used-car prices, there’s no need. Now is the best time to come in and work with the dealership to leave in the vehicle that best suits your needs. We love to say yes! Follow us on Facebook and Twitter to see more news and special monthly offers.